First Class Explaining About Cryptocurrencies

Cryptocurrency is digital money based on blockchain. You might know the most popular ones, Bitcoin and Ethereum, but there are over 9,000 others out there.

How Does Cryptocurrency Work?

A cryptocurrency is a digital, encrypted, and decentralized means of exchange. Unlike the US Dollar or Euro, there is no central authority that controls and maintains the value of a cryptocurrency. Instead, that’s done by the users of a cryptocurrency via the internet.

You can use crypto to buy regular stuff and services, but most people invest in cryptocurrencies as they would other assets, like stocks or precious metals. While cryptocurrency is a new and cool asset class, buying it can be risky as you have to put in a lot of research to fully understand how each one works.

Bitcoin was the first cryptocurrency, first proposed in 2008 by Satoshi Nakamoto in a paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” Nakamoto described the project as “an electronic payment system based on cryptographic proof instead of trust.”

That cryptographic proof comes in the form of transactions that are verified and recorded on a blockchain.

What Is a Blockchain?

A blockchain is an open, distributed ledger that records transactions in code. In practice, it’s a little like a checkbook that’s distributed across countless computers around the world. Transactions are recorded in “blocks” that are then linked together on a “chain” of previous cryptocurrency transactions.

“Imagine a book where you write down everything you spend money on each day,” says Buchi Okoro, CEO and co-founder of African cryptocurrency exchange Quidax. “Each page is similar to a block, and the entire book, a group of pages, is a blockchain.”

With a blockchain, everyone who uses a cryptocurrency has their own copy of this book to create a single transaction record. Each new transaction as it happens is logged, and every copy of the blockchain is updated at the same time with the new information, so all records are identical and accurate.

To prevent fraud, each transaction is verified using a validation technique, such as proof of work or proof of stake.

Proof of Work vs. Proof of Stake

Proof of work and proof of stake are the two most common consensus mechanisms to verify transactions before adding them to a blockchain. Verifiers are then rewarded with cryptocurrency for their work.

Proof of Work

“Proof of work is a method of verifying transactions on a blockchain where an algorithm gives a mathematical problem for computers to solve,” says Simon Oxenham, social media manager at Xcoins.com.

Each participating computer, often called a “miner,” solves a mathematical puzzle that helps verify a batch of transactions—called a block—then adds them to the blockchain ledger. The first computer to do so gets rewarded with a small amount of cryptocurrency for their work. Bitcoin for example, rewards a miner 6.25 BTC (which is roughly $200,000) for validating a new

Solving blockchain puzzles can require a lot of computer power and electricity. So the miners might not even break even with the crypto they get for validating transactions after all the power and computing costs.

Proof of Stake

Some cryptocurrencies use proof of stake to reduce the amount of power needed to verify transactions. With proof of stake, the number of transactions you can verify is limited by the amount of crypto you’re willing to “stake,” or lock up in a communal vault for a chance to participate.

“It’s like bank collateral,” says Okoro. Each person who stakes crypto can verify transactions, but the chances you’ll be chosen increases with the amount you put up.

“Because proof of stake removes the energy-intensive equation solving, it’s much more efficient than proof of work, so verification/confirmation times for transactions are faster,” says Anton Altement, CEO of Osom Finance.

For example, the average transaction time for Bitcoin is at least 10 minutes. Now compare that with Solana, a crypto platform that uses proof of stake, which can do 3,000 TPS, much faster than the slow Bitcoin blockchain.

Consensus in Crypto

Both proof of stake and proof of work use consensus mechanisms to verify transactions. That means while each uses individual users to verify transactions, each verified transaction must be checked and approved by the majority of ledger holders.

How Do You Mine Crypto?

Mining is how new crypto is released into the world, generally in exchange for verifying transactions. While it’s technically possible for anyone to mine crypto, it’s getting harder and harder in proof of work systems like Bitcoin.

“As the network grows it gets more complex and more power is required,” says Spencer Montgomery, founder of Uinta Crypto Consulting. “The average person used to be able to do this, but now it’s just too expensive. There are too many people who have optimized their equipment and technology to outcompete.”

Proof of work cryptocurrencies also require a lot of energy to mine. For example, Bitcoin mining currently uses 127 TWh of electricity per year, more than Norway’s entire annual electricity consumption.

While it’s not practical for the average person to earn crypto by mining in a proof of work system, proof of stake requires less high powered computing as validators are chosen randomly based on the amount they stake. It does however require you to already own a cryptocurrency to participate. (If you have no crypto, you have nothing to stake.)

How Do You Use Crypto?

You can buy goods and services with crypto, especially with Litecoin, Bitcoin or Ethereum, but you can also use crypto as an alternative investment outside of stocks and bonds.

“Bitcoin is the most well known crypto and is a secure, decentralized currency like gold,” says David Zeiler, cryptocurrency expert at Money Morning. “Some people even call it ‘digital gold.’

How to Buy Securely with Cryptocurrency

Buying with crypto is all about what you’re buying.

If you’re making a payment in crypto, you’ll likely need a crypto wallet. One type of wallet is a “hot wallet,” a software program that connects to the blockchain and allows users to send and receive their stored crypto.

Transactions aren’t instant, they need to be verified by something.

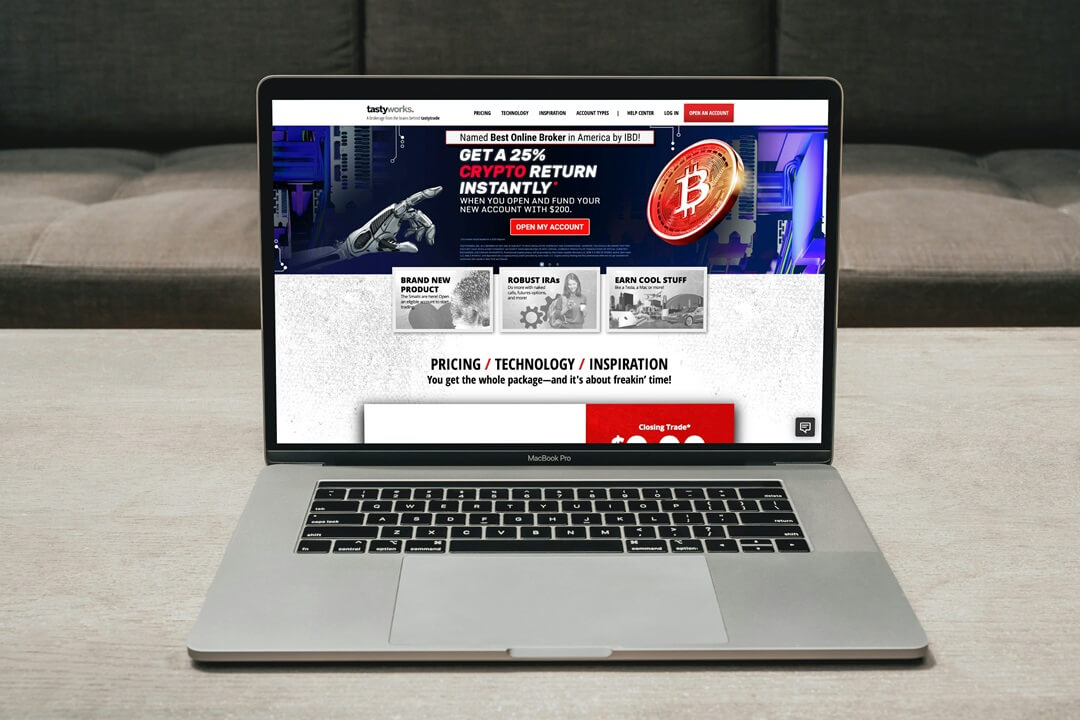

Best Exchanges

Cryptocurrencies can be bought through crypto exchanges like Coinbase. They offer to trade some of the most popular cryptos, including Bitcoin, Ethereum and Dogecoin. But they may also have limitations. You’ll have to check if your exchange supports the right crypto pairing for what you want to buy.

For example, you can use your stash of USD Coin, a crypto stablecoin, to buy Ethereum on Coinbase Exchange.

“It used to be hard but now it’s easy, even for crypto newbies,” Zeiler says. “An exchange like Coinbase is for non-techy people. It’s super easy to sign up and link to a bank account.”

Watch out for fees though, some of these exchanges charge exorbitant fees on small crypto buys.